The Opportunity Accelerating New Fintech Product Development and Launch in the US, UK, and Canada

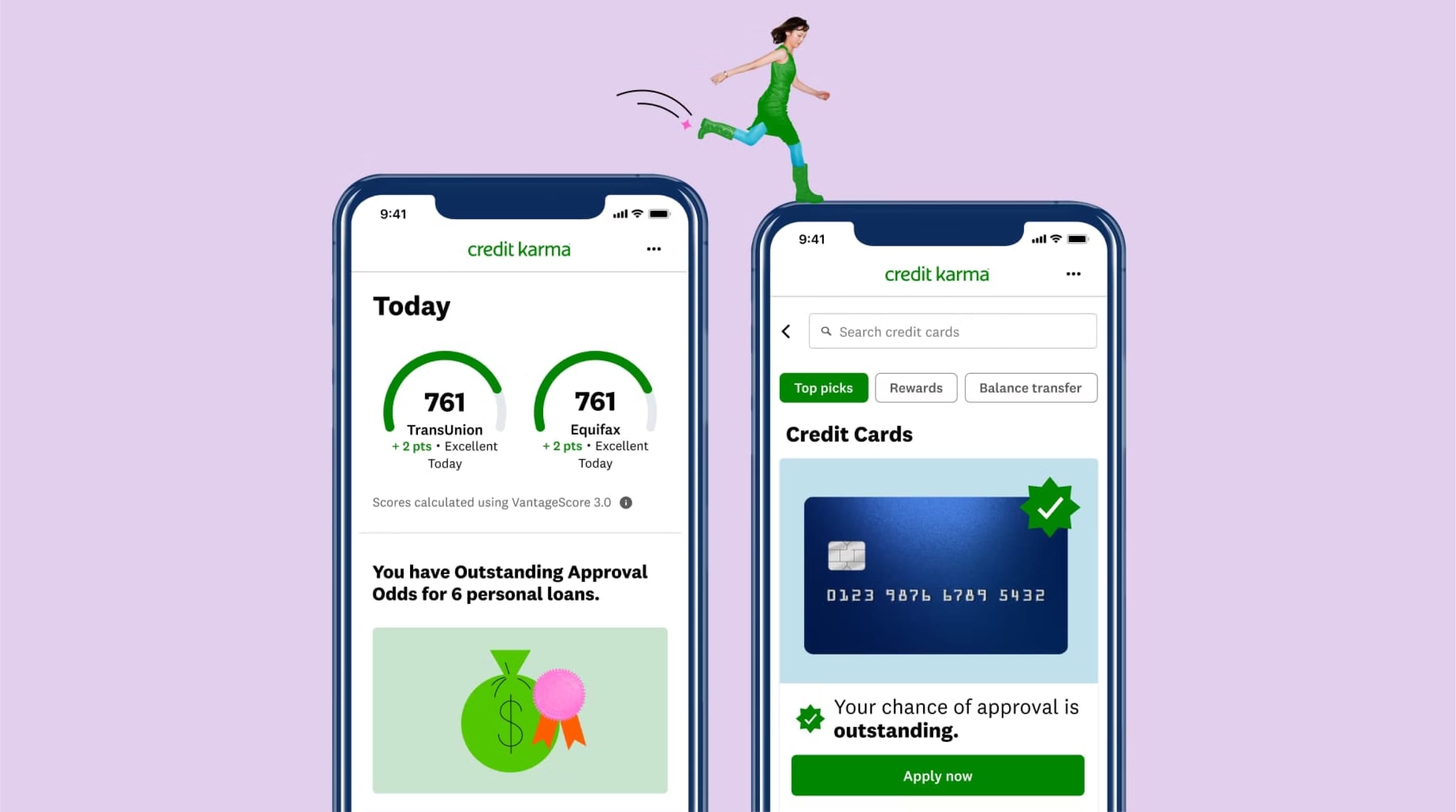

Credit Karma provides technology, data, and personalized advice that empowers users to improve their finances and credit. Domestically, the product has been highly successful, having grown to a 70M member user base. Still, work had to be done on their core offerings to underpin an expansion into their first international markets, Canada and the UK.

Our Response Fintech Product Engineering, Front End Development, and UI Internationalization

Product Engineering

MojoTech’s fintech experience and expertise in React were a perfect fit to augment Credit Karma’s team. We worked with them on various initiatives within their domestic portfolio, including their tax, credit health, personal loans, and credit card marketplace products, to create an architecture that scales with its user base and aligns with their monetization strategies.

MojoTech made enhancements to their offerings in preparation for international launches. We helped Credit Karma identify and rectify issues with their personal loans module to boost conversions. Additionally, we assisted Credit Karma in expanding their fintech suite of software offerings by developing a tax estimation tool that integrated seamlessly with TurboTax.

Front End Development

While the Credit Karma team concentrated on migrating from PHP to Scala, MojoTech focused on the front end. We took a mobile-first approach using React, TypeScript, and GraphQL to ease mobile app latency. Due to the sensitivity of personal financial data and stringent international regulations, we used the Node.js library, Hapi, to securely pass data to the front end. With SEO of paramount importance, MojoTech added server-side rendering to boost page rank and load speeds.

Analytics and A/B Testing

Before creating the international products, ensuring that the user interface supported their monetization strategies and user experience goals was vital. MojoTech implemented multiple iterations of the same front-end features for A/B testing. To see which variation was more successful, we incorporated event-tracking parameters that fed into their proprietary back-end system that analyzed page views, page loads, button clicks, and other critical KPIs.

UI Internationalization

We used our experience with UI internationalization to build a Canadian proof of concept from the domestic suite. Our team created reusable components and page layouts to ensure a consistent feel of the Credit Karma brand and user experience throughout the products. It served as the foundation for the UK offering, which we built from scratch, and is well-positioned to scale in additional international markets and languages.

The Outcome Launching in International Markets Helped Grow Credit Karma to Over 100M Members

30M+ Member Growth

Credit Karma’s active user base has continued to grow since its launch in Canada and the UK. The overall membership has increased to more than 100M, including nearly half of all millennials in the US.

$7.1B Acquisition

In the wake of international and domestic success, Credit Karma agreed to be acquired by Intuit for $7.1B in one of the largest privately held fintech purchases.