Pivotal to Barron’s Advisor Finder platform is a Benchmarking Tool designed as a strategic companion for financial advisors to elevate their professional standing, engage with a broader client base, and gauge their performance against the best in the business. This dynamic interplay between the tool’s analytical capabilities and the ranking process creates a powerful ecosystem for investors and advisors.

The Benchmarking Tool was engineered with the user’s needs at the core of the development process. Recognizing financial advisors’ role in the platform’s success, MojoTech’s team gathered valuable insights from advisors through extensive user interviews. This feedback was instrumental in refining each tool, ensuring they aligned with their real-world needs and expectations.

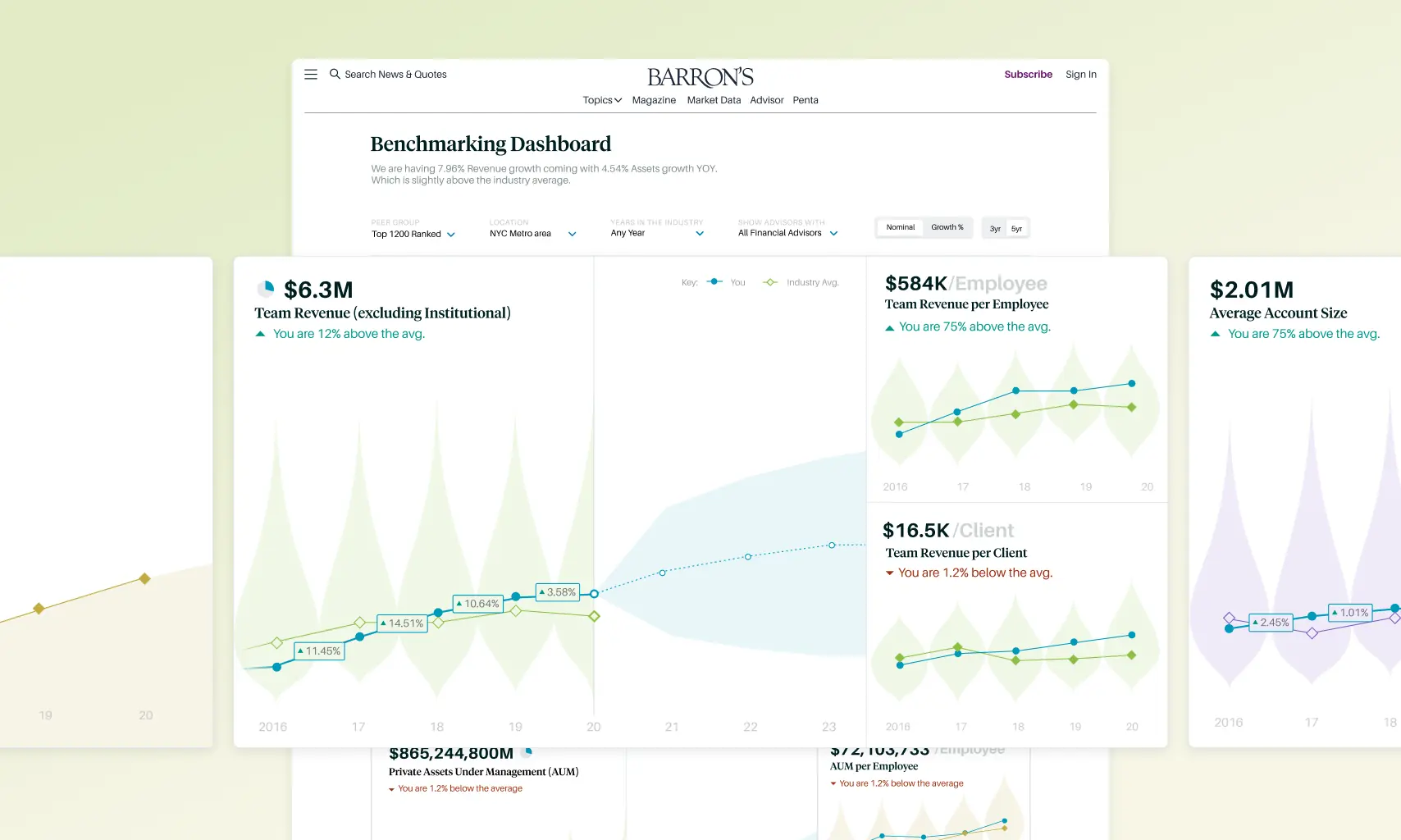

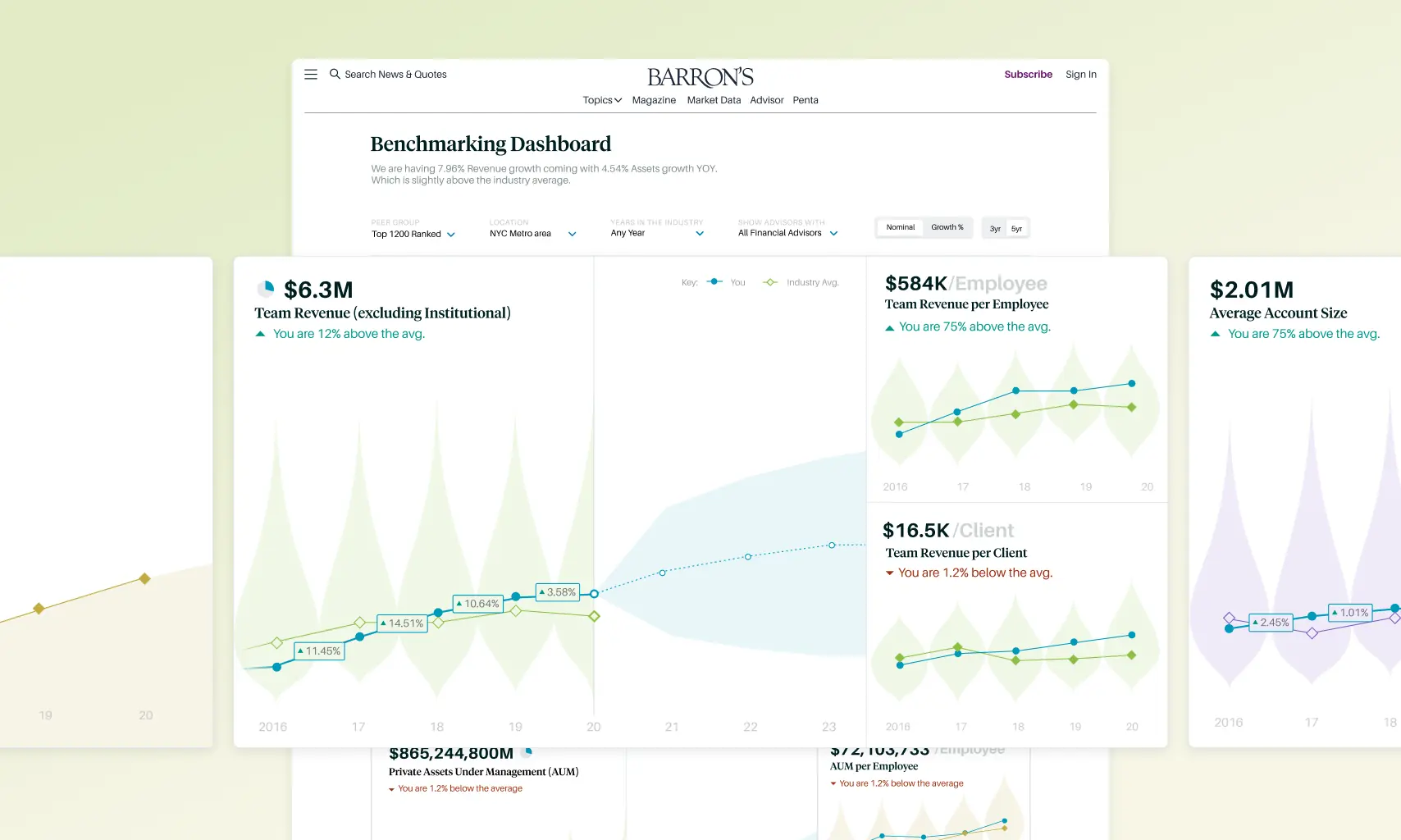

Benchmarking Tool: Innovative Data Visualization & Forecasting Model

To successfully rank on the platform, advisors must permit the Benchmarking Tool to access financial data from third-party platforms. To do so, MojoTech crafted a secure and seamless authorization workflow utilizing Barron’s credentials and designed to fit effortlessly into the daily activities of financial services professionals. Beyond bolstering security, MojoTech tailored the user experience, dynamically adapting it according to each user’s subscription model.

Additionally, advisors are presented with a comprehensive 102-item questionnaire designed to delve into the nuances of their services, performance, and client satisfaction. The questionnaire, designed by MojoTech’s UI/UX experts, is thorough yet unburdensome, capturing a wide range of expertise and the impact on clients’ financial success, which is paramount to the matchmaking process of the Advisor Finder platform.

Once the ranking and questionnaire data are compiled, financial advisors can easily compare their performance and strategies against their peers using the latest data. This comprehensive analysis highlights strengths and areas for improvement and provides actionable insights for strategy enhancement, client engagement, and business growth.

MojoTech used innovative data visualization techniques to make complex financial data accessible and intuitive. Such visuals empower advisors and investors to quickly grasp essential insights, aiding in informed decision-making. The tool also includes a forecasting model to predict future growth, allowing users to stay ahead of market trends and proactively adjust their strategies.

Furthermore, users can pin critical metrics to create a customized dashboard to enhance the platform’s utility. This feature makes the most pertinent data points visible, enabling advisors to monitor and refine their investment strategies. This degree of personalization and emphasis on practical insights highlights the goal of the platform to promote financial prosperity.

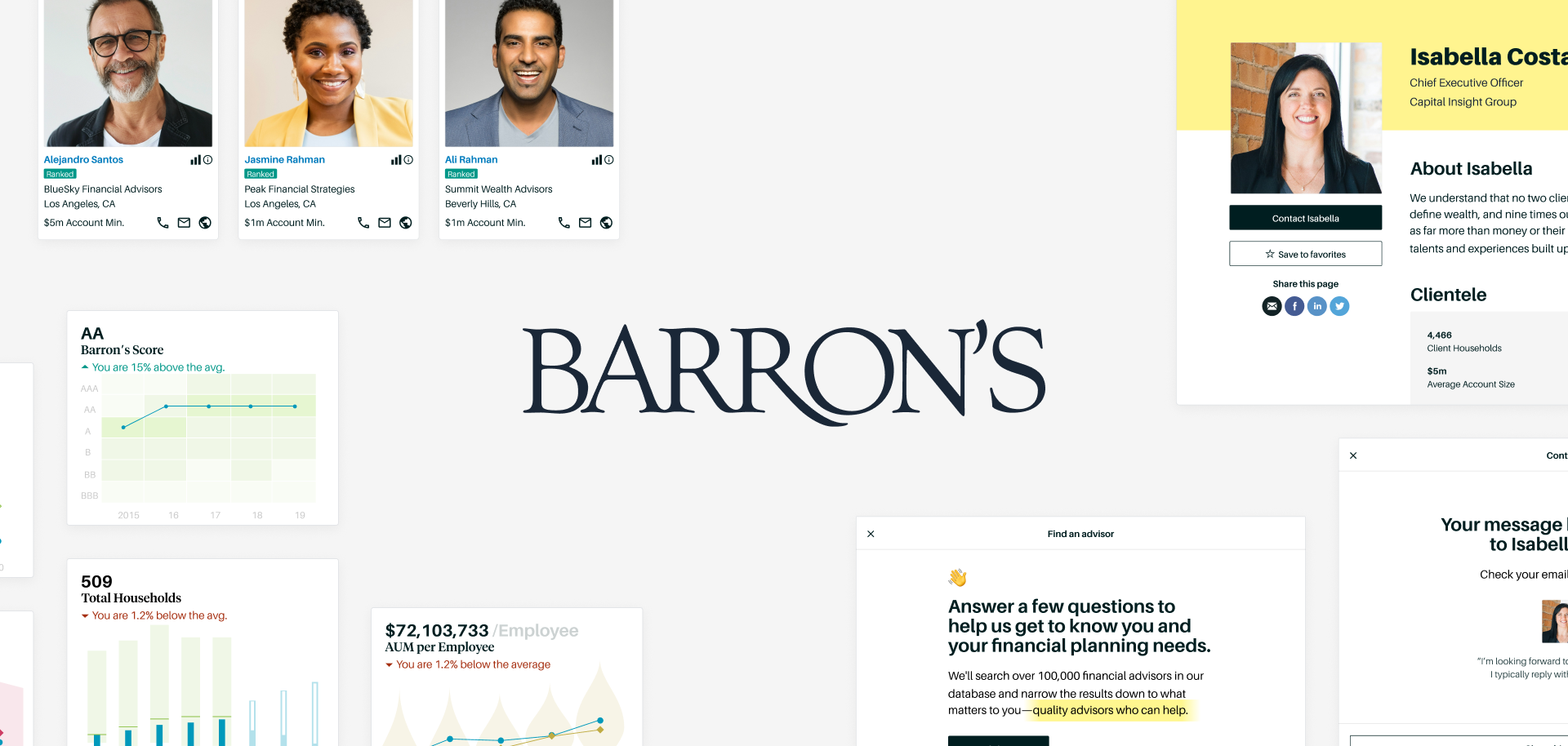

Advisor Finder: Seamless Matchmaking & Curated Content Integration

For investors seeking guidance, the Advisor Finder tool streamlines the process of connecting with qualified financial advisors. Initially, investors are prompted to complete a brief questionnaire detailing their investment goals, experience, style, demographics, and specific investment themes of interest. This information enables the Advisor Finder to match investors with suitable advisors utilizing critical data from the benchmarking tool.

Users have the flexibility to refine their search based on criteria such as advisor type, fee structure, specialty, and location. Additionally, they can organize their results using various benchmarks, including experience, quality, total assets managed, and a sophistication rating. From there, investors can access detailed profiles of advisors, complete with contact information, facilitating direct communication if desired.

Moreover, MojoTech’s integration of curated content into the platform grants users access to a rich repository of insightful articles, in-depth market analyses, and valuable educational resources. Such integration does more than just enrich the platform’s user experience; it empowers users with the knowledge to make well-informed financial decisions, keeping them apprised of the latest financial trends and strategies.