Our Response MojoTech Engineers a Scalable, Mobile-First Banking Platform with Seamless Data Integrations

Integrating Heterogeneous Data Systems into a Single Backend

MoneyLion’s existing infrastructure consisted of several disparate backend systems, both internal and external, each responsible for different aspects of account management, Know Your Customer (KYC), and financial transactions. The mobile application needed to communicate with a single, unified backend to ensure a responsive and fluid user experience. This is crucial for highly responsive systems, such as real-time balance updates and transaction processing.

MojoTech developed a middleware solution to integrate and unify these heterogeneous services. For instance, when a new customer signed up, the middleware ensured that all necessary backend systems were updated simultaneously. However, some of these systems were beyond MoneyLion’s control, and their occasional failures posed a risk to the integrity of customer creation processes. To prevent scenarios where a customer might be "half-created," we built robust validation checks that queried external APIs to confirm the successful completion of each step.

We designed the backend to initiate operations asynchronously, ensuring that even complex, time-consuming processes did not disrupt the user experience. This design allowed us to handle multiple requests simultaneously, which was essential given the high volume of transactions and interactions the platform needed to support.

Building an Auditable and Transparent KYC Data System

Given the complexity of the integration, it was critical to ensure that each customer’s identity was consistently recognized across all systems. It was especially important to fulfill Know Your Customer (KYC) requirements, which demand accurate and reliable customer identification to prevent fraud and comply with regulatory standards.

The challenge was compounded by the need to control the IDs generated by third-party systems. To address this, we implemented a robust identity mapping system that could track and reconcile customer identities across disparate platforms. This solution ensured that the same customer could be accurately identified throughout the MoneyLion ecosystem, regardless of the ID source. By doing so, we maintained data integrity and provided a seamless user experience where all interactions felt cohesive and connected, aligning with KYC mandates.

Another critical aspect of the backend development was ensuring full auditability of all operations. Given the sensitivity of financial transactions and the stringent KYC regulations, it was imperative that every action taken on the platform could be traced back with a complete audit trail. Whether it was a batch operation triggered by the system or a user-initiated transaction, our infrastructure recorded pertinent details. This allowed for thorough audits in case of discrepancies or issues, ensuring compliance with regulatory requirements and offering MoneyLion’s customers a secure and trustworthy banking experience.

A Scalable and Reliable Banking System

We chose Java as the primary programming language because of its scalability and compatibility with MoneyLion’s existing infrastructure. This choice allowed us to build a robust platform to handle the growing demands of a rapidly expanding user base.

Furthermore, as the Demand Deposit Account (DDA) platform grew, it became crucial to migrate it from in-house data centers to the cloud. This migration and adoption of a microservices architecture enabled us to scale, ensuring the platform could handle the increasing load without sacrificing performance or reliability.

User-Friendly Account Setup and Alerts

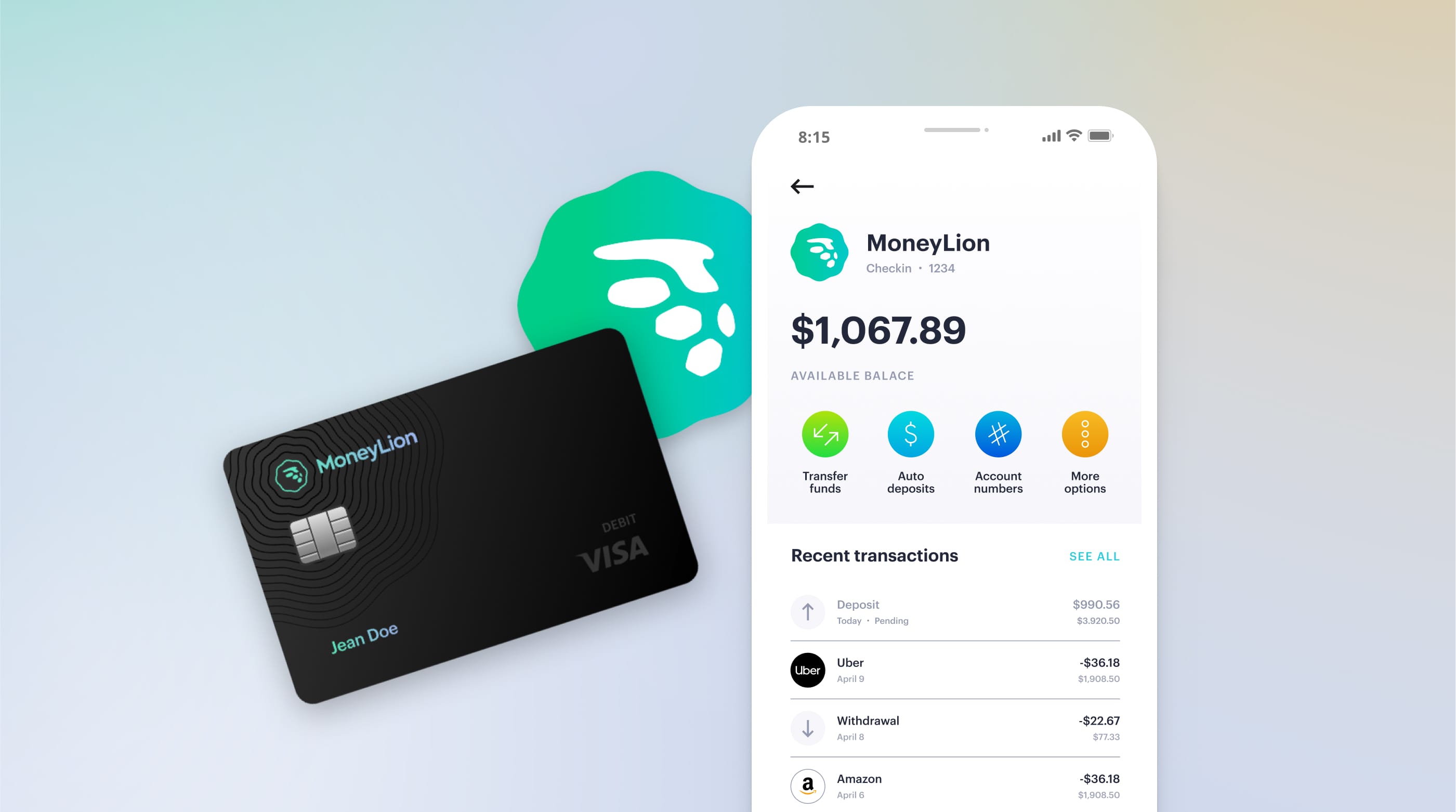

From a front-end perspective, we ensured the account creation experience was intuitive and user-friendly. We developed a simple interface that allowed customers to easily view their statements, check current balances, and initiate transfers. We also built a robust event handler and notification system that sent push notifications to customers when their account balances were updated or other important events occurred.

The Outcome MojoTech’s Fintech Expertise Helps MoneyLion Achieve 5 Million Active Users and a $1 Billion Valuation

Through our transformative collaboration with MoneyLion’s engineering and finance teams, we developed a mobile-first banking platform seamlessly integrated with their existing fintech ecosystem. MojoTech was pivotal in building the front and back ends of the new DDA service. We engineered API endpoints for critical functions like customer ID verification, KYC, bank account creation, debit card issuance, and more. Additionally, we created datasets that delivered valuable insights to MoneyLion’s analytics team and stakeholders.

The result was a superior banking experience that empowered MoneyLion customers to take greater control of their finances. Since the launch of the new mobile platform, MoneyLion has seen extraordinary growth, with over 5 million active users now relying on the software we built. The success of this partnership was further underscored when MoneyLion secured $100 million in funding, achieving a near $1 billion valuation shortly after the launch.