Banking Software Development & Consulting Redefining Banking for the Digital Future

We empower banking and financial service providers to navigate the fintech ecosystem, seamlessly integrating the platforms and services needed to deliver exceptional products that elevate their customers' financial well-being.

Increase Convenience

Provide personalized financial services and products precisely when and where needed, seamlessly integrating into consumers' personal or business financial journeys.

Expand Customer Base

Unlock revenue opportunities by integrating investment and credit products with embedded finance and marketplace strategies that align with your business goals.

Modernize Systems

Digitally transform legacy systems into a scalable foundation to align with modern fintech innovations to increase development velocity, improve accessibility, and enhance engagement.

Decrease Fraud

Identify critical fraud vectors and develop comprehensive strategies and countermeasures to detect, mitigate, and prevent fraudulent activities and emerging threats.

Banking Software Consulting Services

Banking Strategy

Our PMs deliver market-focused digital product strategies and development roadmaps, empowering financial services providers to offer innovative banking products, services, and experiences.

Accessibility & APIs

Unify and scale digital, mobile, and in-branch experiences while enabling third parties through open banking APIs, ensuring real-time, secure data access across customer touchpoints.

AI & Operations

Our AI consulting experts develop a comprehensive strategy aligned with your goals by identifying use cases and defining a roadmap that capitalizes on high-impact AI initiatives.

Offers & Monetization

Maximize engagement and increase conversion rates through strategic offer placement, testing, tracking, and optimized omnichannel strategies.

Data & Funnel Optimization

Fuse first-party customer insights on behavior, preferences, and needs with strategic partners and marketplaces to drive persistent revenue optimization and growth.

Banking Experiences & UI

Transform banking experiences with forward-thinking UX/UI design that prioritizes simplicity, security, and personalization to drive usage, trust, and conversions.

Tech Due Diligence

We evaluate third-party financial technology vendors to ensure they exceed high performance, reliability, and cost-effectiveness standards.

Risk & Compliance

Minimize risks for your product or platform with secure and transparent solutions that ensure compliance with banking regulations, including GLBA, AML/KYC, and GDPR.

Our Banking Development Expertise

MojoTech's software engineering services enable banks, credit unions, and fintech companies to thrive in the financial landscape by seamlessly integrating third-party technologies to unlock meaningful business opportunities.

Core Banking

Our experts build on top of banking cores, enhancing them with next-gen, open, and modular architectures to seamlessly integrate cutting-edge tools, technologies, and real-time data that deliver superior services, omnichannel user experiences, and security.

Accounts & Onboarding

We craft frictionless, intuitive account creation and onboarding experiences backed by robust analytics and reporting to ensure you Know Your Customers while maintaining full compliance with regulatory standards.

Card Issuing

MojoTech integrates comprehensive card-issuing platforms that support physical, virtual, and tokenized credit, debit, and prepaid cards with dynamic rewards and loyalty programs designed to deepen customer engagement and strengthen relationships.

Payments & Transfers

We integrate issuer processing systems to ensure secure payments solutions and facilitate ACH transactions, streamlining the management of cardholder accounts and ensuring efficient authorization, clearing, and settlement processes.

Ledger Infrastructure

Our banking specialists integrate homegrown or third-party ledgers with custom business logic to manage real-time transactions, ensuring reliable settlement, precise cash reconciliation, and comprehensive financial reporting.

Virtual Wallets

MojoTech creates virtual wallets that handle a range of tokenized assets, including debit, credit, prepaid, and loyalty virtual cards, cryptocurrencies, and direct bank account access that facilitate versatile payment options such as NFC, QR, and P2P transactions.

Mobile Banking Apps

We develop mobile apps and scalable mobile-first architectures, leveraging cloud, microservices, and user-centric design to extend existing banking services for mobile functionality and add features such as remote deposit capture.

Fraud Detection

Our AI engineers develop fraud detection and prevention solutions using cutting-edge AI and machine learning algorithms to identify fraudulent activities, reduce chargebacks, bolster payment security, and build lasting customer trust.

KYC/KYB

MojoTech automates data collection and develops APIs for real-time validation of personally identifiable information, enabling businesses to enhance compliance, streamline onboarding, and reduce risks associated with data handling and fraud.

Custom Banking Solutions

Our fintech consultants devise a user-centric approach to ensuring that your B2B or B2C banking products or platforms meet market demands and excel in the competitive landscape.

Embedded Banking

MojoTech transforms financial marketplaces and embedded strategies with tailored customer experiences, enhancing secure authentication, seamless integrations, strategic offer placement, and lifecycle marketing.

Integration Layers & APIs

Seamlessly connect with third-party systems to drive innovation and enhance your banking offerings through a flexible, API-driven ecosystem that ensures fast, secure information exchange and effortless integration of digital-first solutions into core systems.

AI & Machine Learning

Leverage our artificial intelligence & ML expertise to transform banking operations to automate customer support, enhance experiences through personalization, generate reports and summaries, detect fraud, ensure compliance, and assess risk.

Data Analytics & Reporting

Drive down CAC and maximize ARPU by leveraging our data engineering services to deliver personalized product offerings, advanced risk assessment models, innovative financial solutions, and comprehensive reporting for enhanced transparency and compliance.

Our Fintech Platform Experience

By collaborating with fintech giants and integrating industry-leading platforms, we deliver world-class solutions that drive competitive advantages and establish our partners as market leaders.

Fraud, AML & KYC

Plaid

Riskified

TransUnion/Experian/Equifax

Forter

Sardine

Socure

Payments & Card Issuing

Stripe

Adyen

PayPal

Lithic

Fiserv

Zelle

Visa/Mastercard

Nium

Braintree

Checkout.com

Lightspeed

Marqeta

Dwolla

Lending

Credit Key

MoneyLion

Peach

Parafin

Capital Markets

iCapital

DriveWealth

Alpaca

Banking-as-a-Service

Galileo

Greendot

Plaid

Unit

Treasury Prime

Column

Helix

Income Verification & Payroll

Atomic

Finch

Codat

Featured Fintech Case Studies

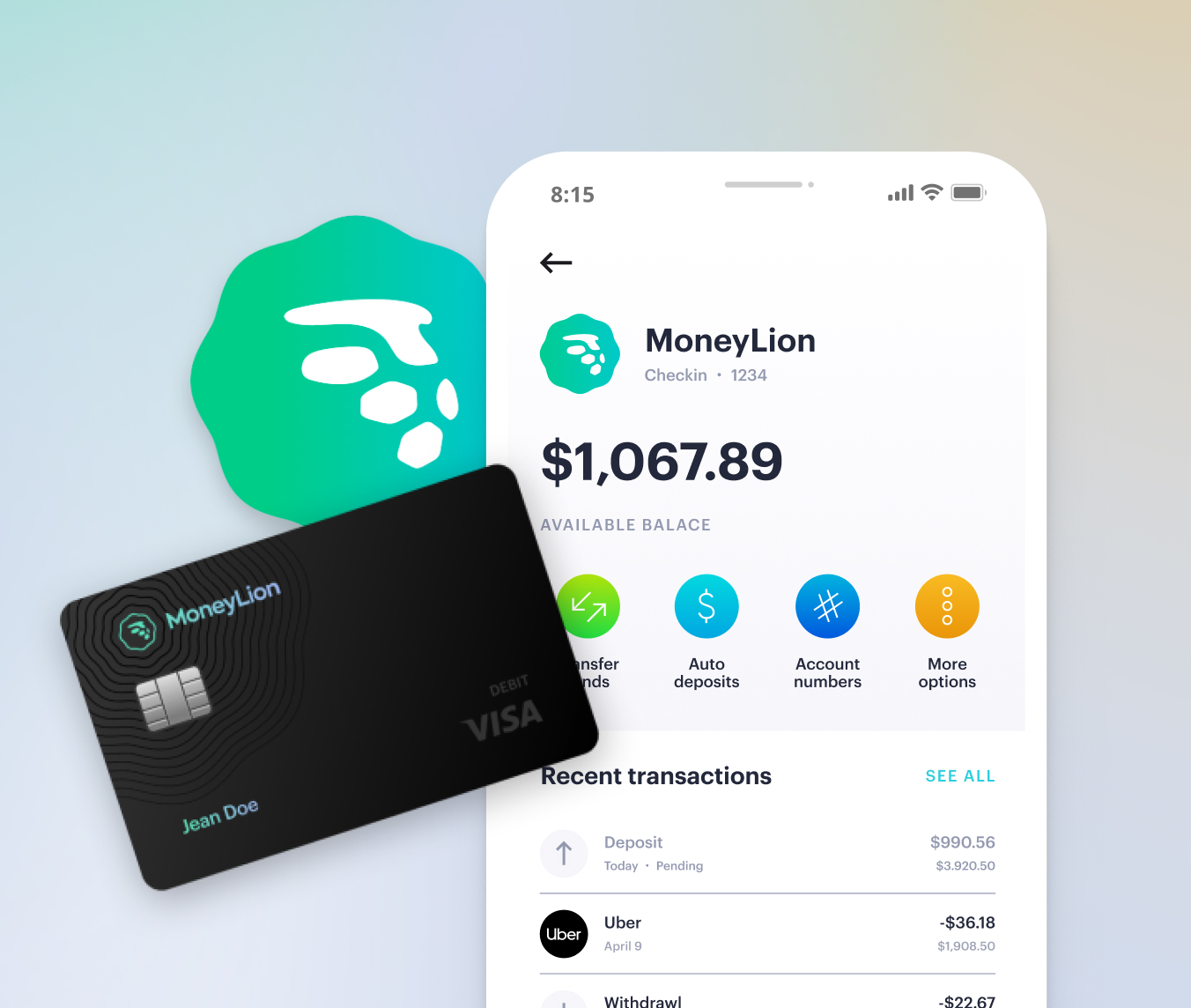

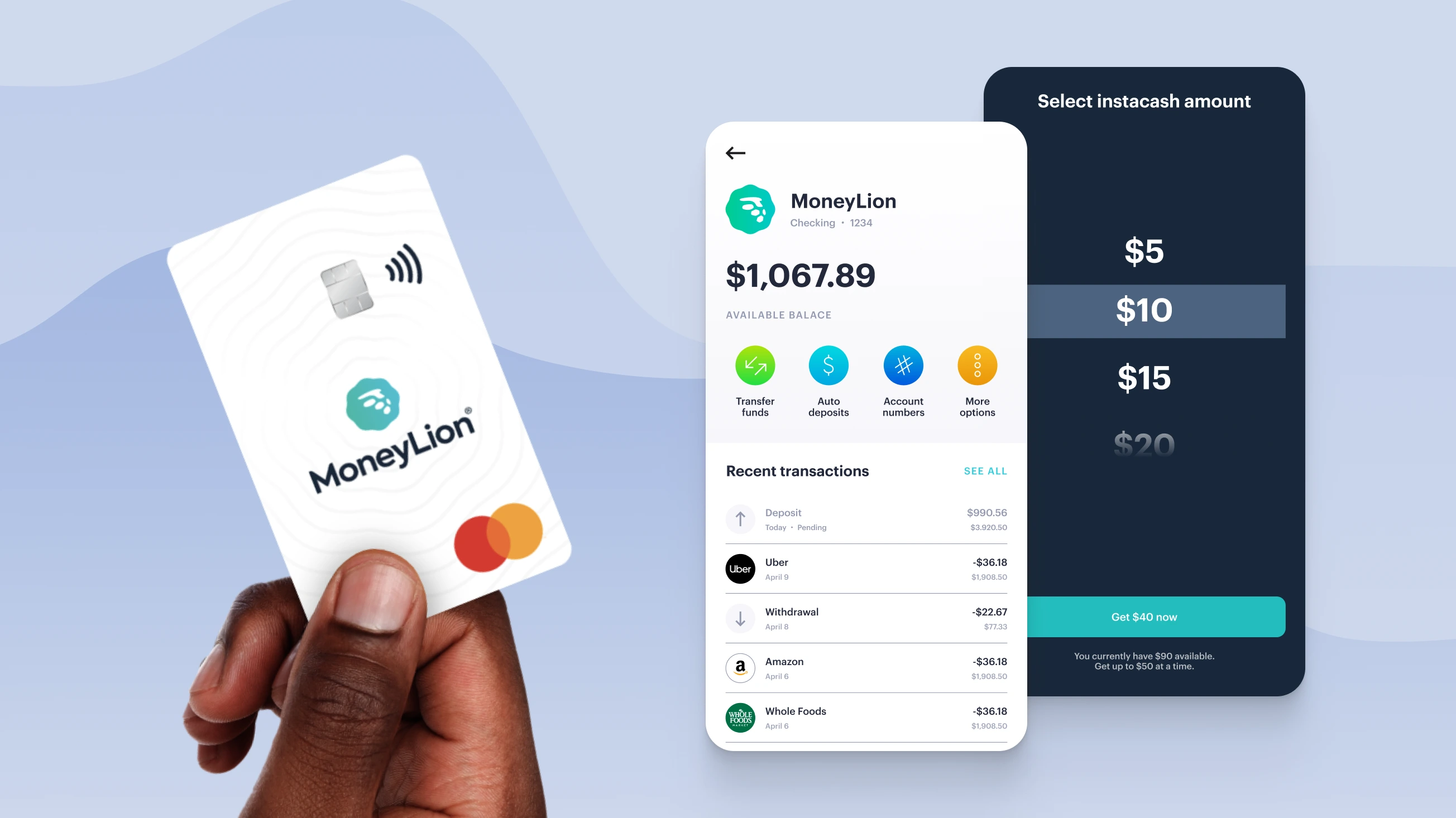

MoneyLion: Mobile Banking Product Development Helps Fintech Suite Scale

Mobile app development and cloud-native architectures create an easy-to-use mobile-first banking experience.

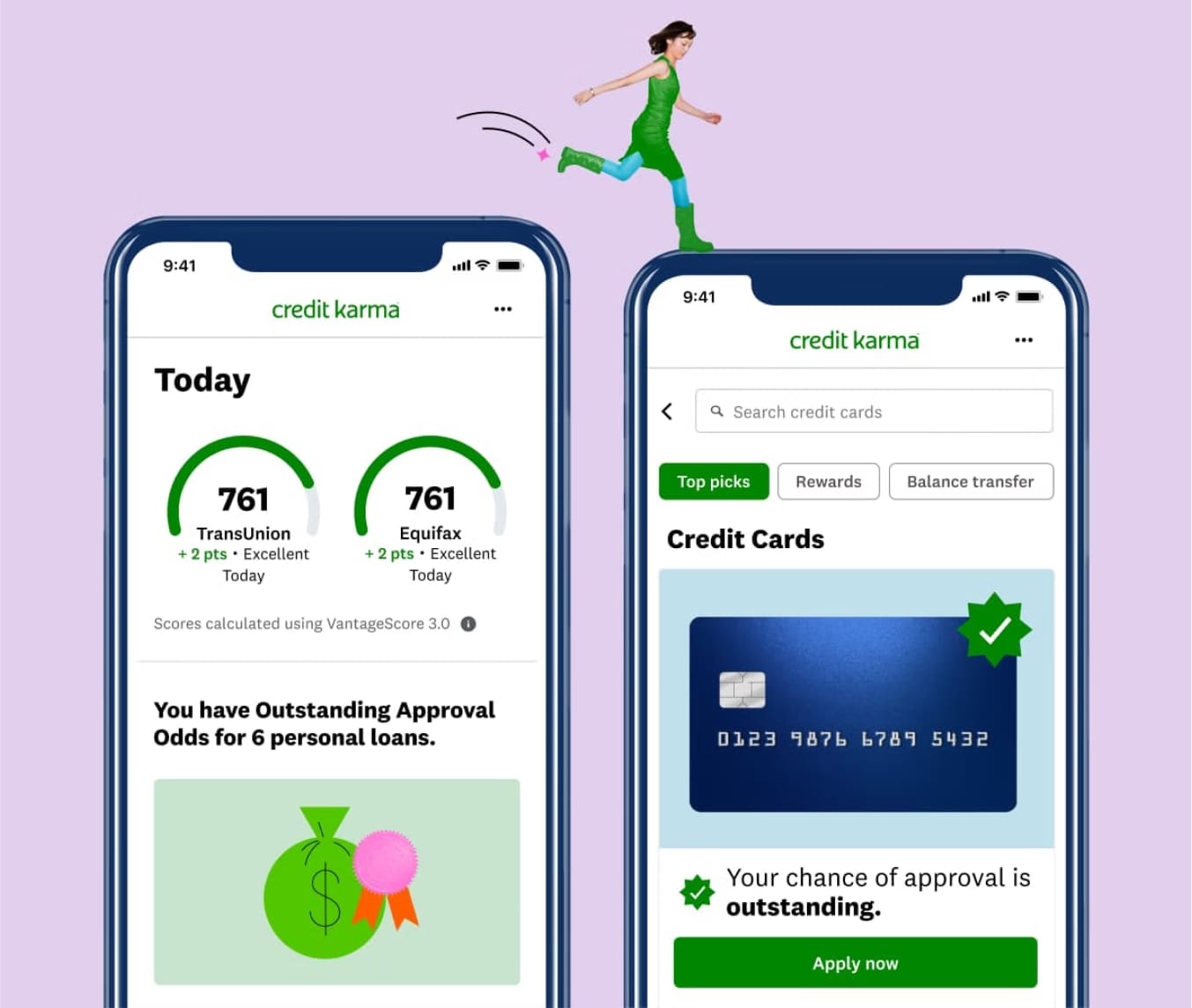

View Case StudyCredit Karma: Expanding the Most Modern Credit Monitoring Service into New Markets

Product engineering, UI/UX internationalization & integrations accelerate Fintech product launch in US, UK & Canada.

View Case Study