Payments Consulting & Development Services Strategic Payments Solutions

We empower fintechs, banks, retailers, and businesses with payments solutions that ensure money moves effortlessly, efficiently, and securely.

Reduce Costs

Simplify payment processes by cutting through the complex web of banks and intermediaries, creating direct channels that eliminate fees and bypass expensive networks.

Streamline Experiences

Reduce friction by tailoring payment workflows to user's needs, transforming transactions into engaging experiences that drive growth and customer satisfaction.

Increase Revenue

Unlock revenue growth by expanding payment options, supporting local currencies, and leveraging marketplaces and integrations for upselling and cross-selling opportunities.

Decrease Fraud

Identify critical fraud vectors and develop comprehensive strategies and countermeasures to effectively detect, mitigate, and prevent fraudulent activities and emerging threats.

Payments Consulting Services

Payments Strategy

Our experts deliver holistic product strategies that empower businesses to elevate their payments capabilities the complexities of the payments ecosystem.

Payment Rails Optimization

MojoTech helps you significantly cut transaction costs and boost financial performance by ensuring efficient routing and cost-effective payment processing.

Interchange & Fee Audit

Our auditors identify pricing gaps and uncover cost-saving opportunities, ensuring you pay the lowest possible processing rates while securing retroactive credits.

Accessibility & APIs

We evaluate and enable proprietary or 3rd party payment solutions to seamlessly integrate and embed within e-commerce platforms, marketplaces, mobile apps, banking services, and POS.

CX & Conversions

MojoTech assesses your payment workflows to optimize interfaces and transaction experiences, driving conversions with personalized features, one-click checkouts, and localized options.

Data Warehousing & Analytics

Maximize the potential of your payments data with advanced data modeling and intuitive data reporting that enable you to monitor real-time performance and trends at a glance.

Risk & Compliance

We minimize risks for your product or platform, delivering secure and transparent solutions that ensure compliance with payment regulations, including PCI, AML/KYC, and GDPR.

Our Payments Development Expertise

MojoTech develops cutting-edge payment solutions by creating custom integration layers or building systems from the ground up, seamlessly orchestrating payment infrastructures to streamline transactions, enhance efficiency, and optimize user experiences.

Payment Processing

We develop robust payments and transaction processing systems that facilitate secure and efficient financial exchanges, supporting various payment methods, currencies, crypto, and integrations with payment gateways and financial networks.

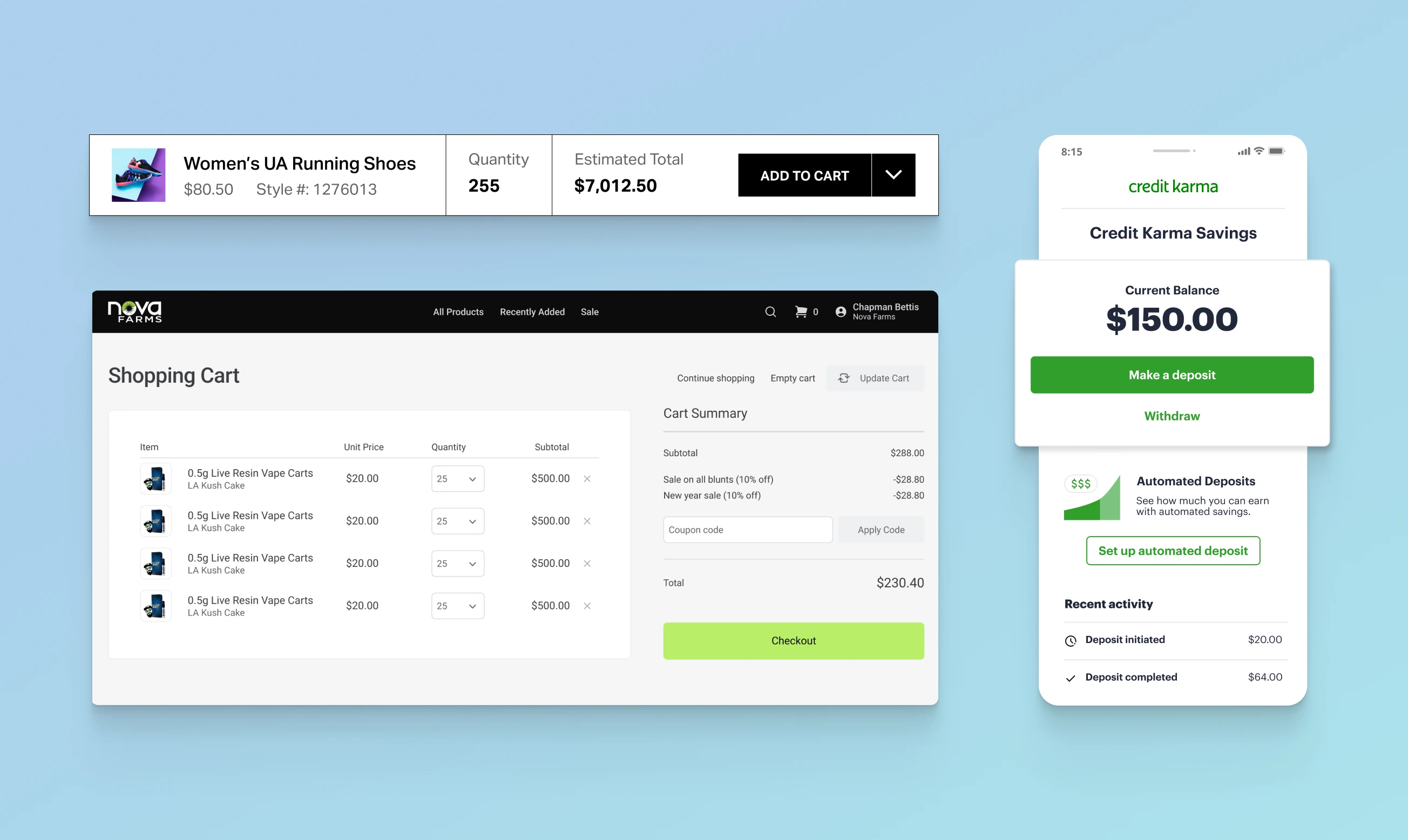

Online Payments & Carts

Our experts empower businesses with seamless, localized online payment solutions that combine tailored customer experiences, diverse payment options, and adaptive verification technology to facilitate secure, effortless transactions on any device, anywhere in the world.

In-Person Payments & POS

MojoTech engineers robust terminal and kiosk POS systems, leveraging the latest payment hardware to deliver seamless multichannel payment processing, real-time data synchronization, and interoperability across locations and back-office systems.

Accounts & Onboarding

We craft frictionless, intuitive account creation and onboarding experiences backed by robust analytics and reporting to ensure you Know Your Customers while maintaining full compliance with regulatory standards.

Authorization & Reconciliation

Our payments specialists integrate homegrown or third-party ledgers with custom authorization logic to manage real-time transactions, ensuring reliable settlement, accurate interchange reporting, precise cash reconciliation, and tailored financial reporting.

Card Issuing

MojoTech integrates comprehensive card-issuing platforms that support physical, virtual, and tokenized credit, debit, and prepaid cards with dynamic rewards and loyalty programs designed to deepen customer engagement and strengthen relationships.

Virtual Wallets

We create sophisticated virtual wallets that handle a range of tokenized assets, including debit, credit, prepaid, and loyalty virtual cards, cryptocurrencies, and direct bank account access that facilitate versatile payment options such as NFC, QR, and P2P transactions.

Fraud Detection

Our AI engineers develop fraud detection and prevention solutions using cutting-edge AI and machine learning algorithms to identify fraudulent activities, reduce chargebacks, bolster payment security, and build lasting customer trust.

KYC/KYB

MojoTech automates data collection and develops APIs for real-time validation of personally identifiable information, enabling businesses to enhance compliance, streamline onboarding, and reduce data handling and fraud risks.

Custom Payments Solutions

Our fintech consultants devise a user-centric approach to ensuring that your B2B or B2C product or platform meets market demands and excels in the competitive landscape.

Embedded Payments

Seamlessly integrate payment solutions directly into your or complementary platforms, applications, and processes using our deep experience in healthcare, retail, e-commerce, marketplaces, energy, and utilities.

Cross-border Payments

Simplify international financial transfers with advanced fintech, integrating Know Your Customer / Business for security and using sophisticated payment rails for efficient cross-border transactions.

Real-time Payments

Adopt interoperable and convenient real-time payments (RTP) systems that allow the immediate transfer and settlement of funds between banks and financial institutions.

Micropayments

Boost ARPU by integrating personalized micropayment solutions into your digital products, ensuring a balance between individualized transactions and stable ARR membership revenue.

Buy Now, Pay Later

Enhance the convenience of shopping experiences with flexible, secure, and seamlessly integrated BNPL options for both online and in-store transactions.

Featured Fintech Case Studies

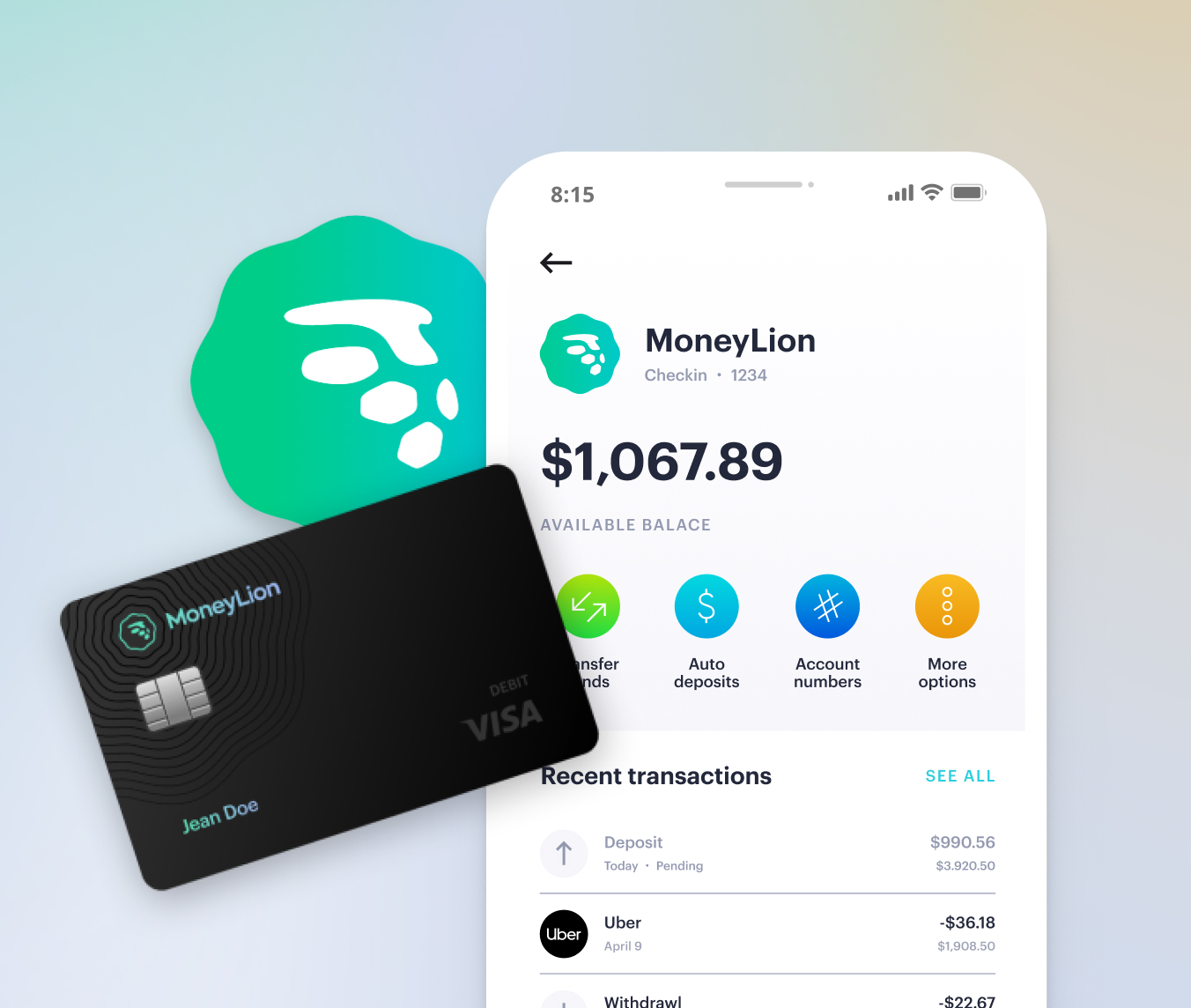

MoneyLion: Mobile Banking Product Development Helps Fintech Suite Scale

Mobile app development and cloud-native architectures create an easy-to-use mobile-first banking experience.

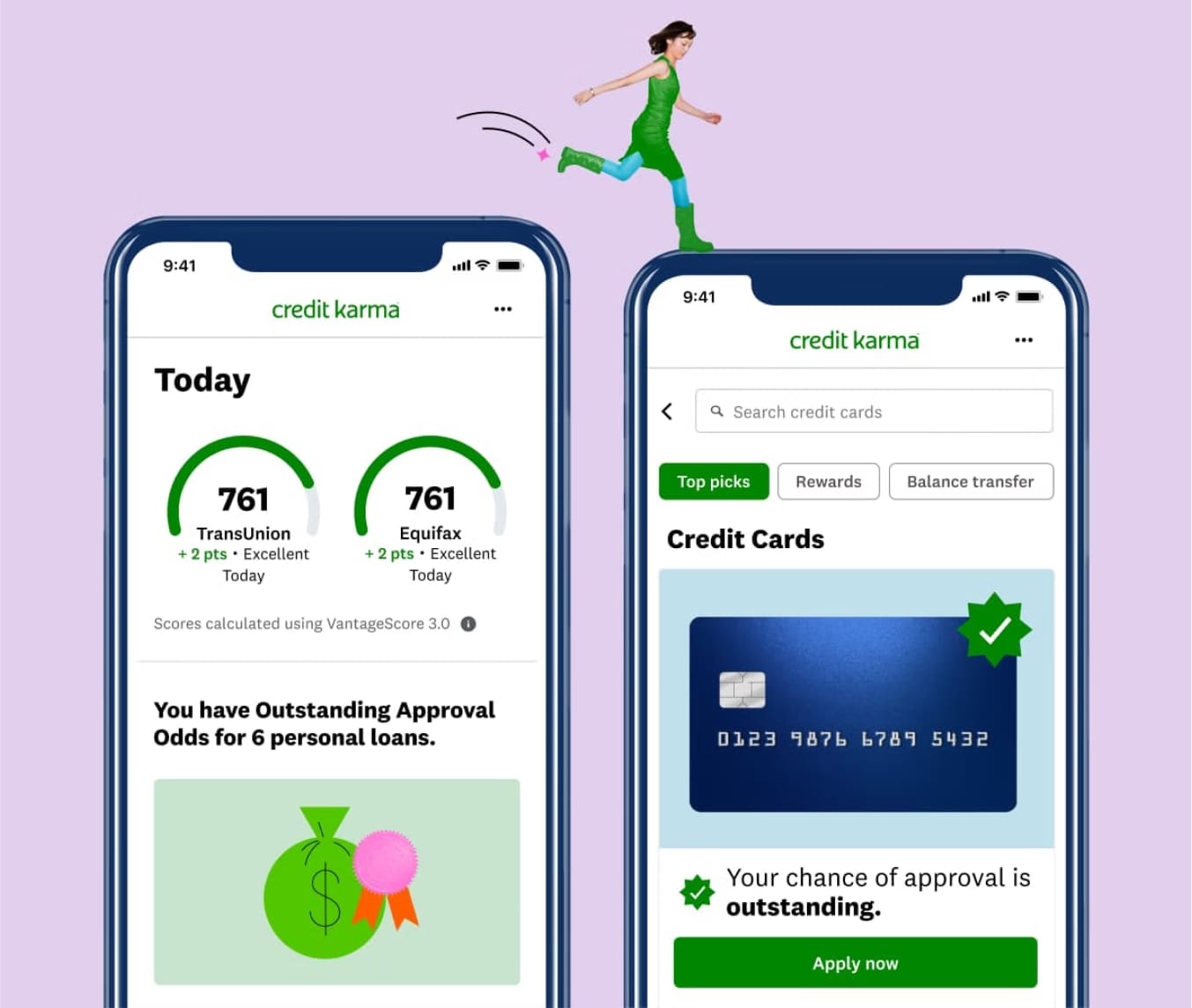

View Case StudyCredit Karma: Expanding the Most Modern Credit Monitoring Service into New Markets

Product engineering, UI/UX internationalization & integrations accelerate Fintech product launch in US, UK & Canada.

View Case Study