Fintech Software Development & Consulting Unlocking Success with Fintech Strategy Acceleration

MojoTech transforms business opportunities into finely tuned fintech platforms fueled by user and market insights and delivered by high-performing product management and engineering teams.

Faster Times to Market

Capture market opportunities ahead of your competition by shortening development cycles from concept to deployment, enabling the swift launch of innovative fintech solutions.

Drive Funnel Conversions

Optimize and reduce friction in your digital funnel by integrating advanced analytics, AI-driven personalization, and simplified workflows to convert prospects into loyal customers.

Shorten Payback Periods

Reduce time to profitability and quickly recover development and deployment costs with strategic solutions designed to maximize revenue potential.

Accelerate Revenue & ROI

Unlock revenue streams and boost return on innovation with strategic fintech solutions that require speed, scale, security, and innovation.

Fintech Software Consulting

Strategy & Roadmap

We navigate complex scenarios in finance to deliver a clear product strategy that provides actionable insights and roadmaps that drive your product's success.

Offers & Monetization

Maximize engagement and increase conversion rates through strategic offer placement, testing, tracking, and optimized omnichannel strategies.

Tech Due Diligence

We assess third-party financial technology vendors to ensure they exceed high performance, reliability, and cost-effectiveness standards.

Accessibility & APIs

Our experts evaluate and enable proprietary or 3rd party fintech solutions to seamlessly integrate and embed within analogous platforms, marketplaces, apps, and infrastructures.

Risk & Compliance

We minimize risks for your product or platform, delivering secure and transparent solutions that ensure compliance with regulations, including PCI, AML/KYC, and GDPR.

Scaling & Modernization

We refine and build on top of products to achieve market fit, swiftly resolving technical issues at the core and facilitating seamless growth for companies needing to scale.

We Help Our Clients Reach Their Goals

Our Fintech Development Experience

Our fintech experts excel in user-centric product development and design, engineering custom web and mobile solutions that solve problems, maximize engagement, and increase transactions.

Payments

We develop payment solutions by creating custom integration layers or building systems from the ground up, seamlessly orchestrating payment infrastructures to streamline transactions, enhance efficiency, and optimize user experiences.

Banking

MojoTech's banking software engineers assist finserves in navigating the complex financial ecosystem, seamlessly integrating third-party innovations to create secure and scalable digital banking platforms for card issuing, deposit accounts, payments, KYC, and more.

Mortgages & Lending

Our fintech developers deliver cutting-edge solutions for consumer, business, and P2P lending platforms, empowering them with custom software for credit scoring, credit cards, cash advances, debt collection, and trade and supply chain finance.

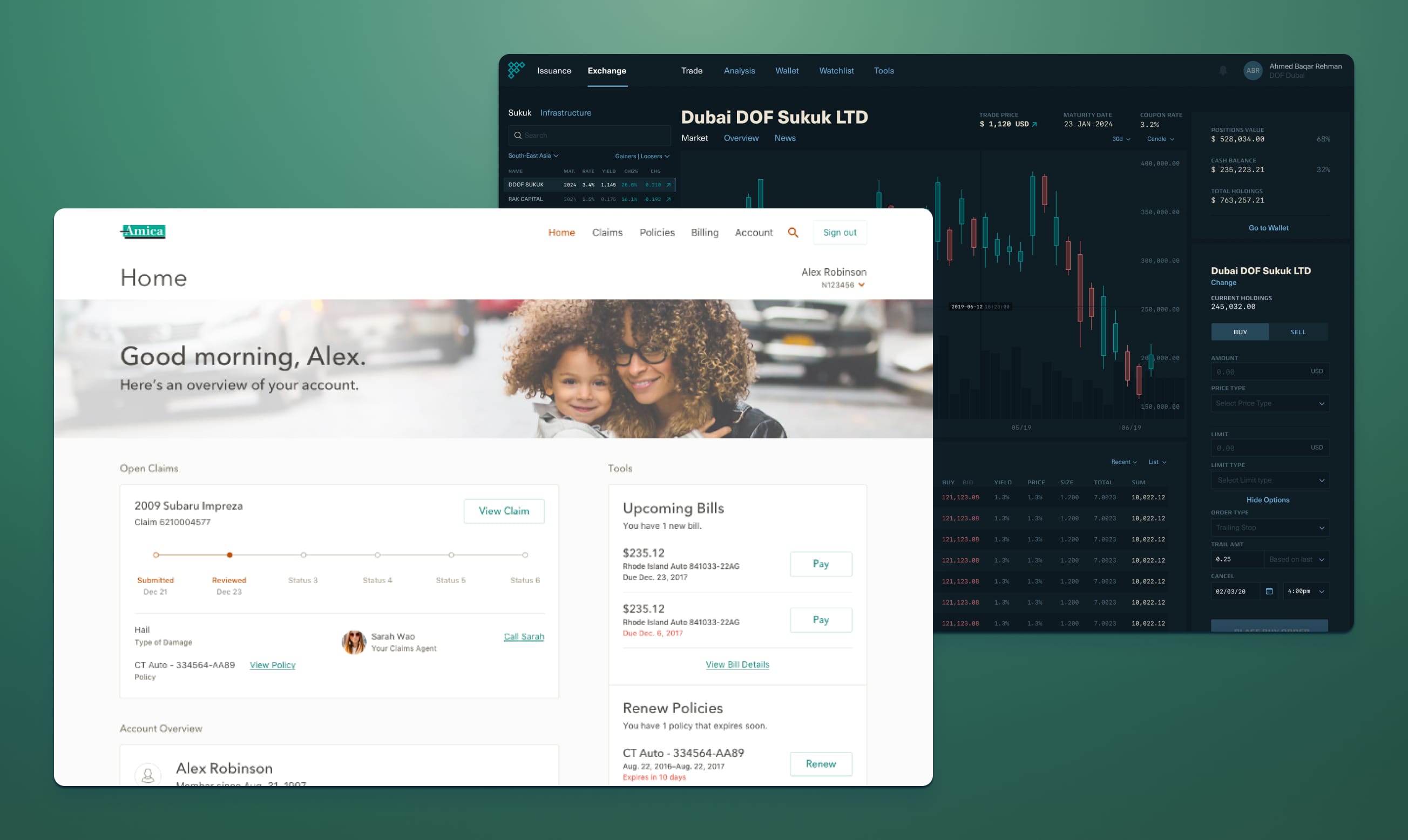

Insurtech

MojoTech delivers robust insurtech solutions tailored to the entire insurance value chain with scalable tools for risk pooling, distribution, brokerage, claims management, policy administration, underwriting, and customer engagement.

Taxes, Credits & CFO

We streamline and automate personal and corporate finance functions from budgeting, accounting, AP/AR, and credit software to intuitive expense management and bookkeeping tools, ensuring accuracy, transparency, and compliance at every juncture.

Wealthtech

Our experts create advanced wealth management platforms that integrate intuitive personal finance tools with robust solutions for advisors, investors, and institutions, enabling efficient management of investments, trading, and financial planning in capital markets.

Marketplaces

We engineer and design unique customer experiences for financial marketplaces, focusing on maximizing engagement by strategically placing offers and effectively monetizing embedded financial platforms to drive continuous revenue optimization.

Regtech

Our solutions seamlessly blend tracking and transparency into cutting-edge anti-money laundering, KYC, and fraud management solutions tailored to comply with the standards set by PCI-DSS, PSD2, GDPR, SOX, FINRA, SEC, and HIPAA.

Custom Fintech Development Solutions

We leverage our financial technology expertise to devise a user-centric approach that ensures your product meets market demands and shines in the competitive landscape.

Embedded Finance

We draw on deep experience in retail, marketplaces, healthcare, energy, and utilities to seamlessly integrate financial services and fintech solutions directly into complementary platforms, applications, and processes.

Financial Infrastructures

MojoTech crafts innovative, cloud-native, and API-first financial infrastructure-as-a-service solutions that empower businesses to build scalable, secure, and user-centric B2B2X platforms, driving innovation and seamless financial integration.

Integration Layers & APIs

Seamlessly connect with third-party systems to drive innovation and enhance your fintech offerings through a flexible, API-driven ecosystem that ensures fast, secure information exchange and effortless integration of digital-first solutions.

Data Warehousing & Analytics

Drive down CAC and maximize ARPU by leveraging our data engineering services to deliver personalized product offerings, advanced risk assessment models, innovative financial solutions, and comprehensive reporting for enhanced transparency and compliance.

Fintech App Development

We develop web and mobile app solutions that tightly integrate with back-end systems, delivering the power, security, and functionality required by the world’s most demanding fintech organizations.

User Experiences & UI Design

Transform digital experiences with forward-thinking UX/UI design that prioritizes simplicity, security, and personalization to drive usage, trust, and conversions.

Fintech AI Consulting

Our AI consulting experts develop a comprehensive strategy aligned with your goals by identifying fintech use cases and defining a roadmap that capitalizes on high-impact AI initiatives.

Content Generation & Summarization

Harness AI to transform structured and unstructured data into comprehensive reports, concise summaries, and engaging financial content.

AI Agents & Customer Support

Deploy AI agents to automate routine queries, empower human agents with advanced tools, and efficiently deliver personalized financial services and product functionalities.

Fraud Detection & Compliance

Leverage AI to detect fraudulent activities in real-time and streamline compliance processes like AML and KYC, ensuring robust regulatory adherence.

Data Augmentation

Utilize AI to aggregate, cleanse, and structure data from diverse sources to enable advanced analytics and decision-making in financial workflows.

Predictive Insights & Personalization

Tap into AI's predictive capabilities to optimize financial forecasts, enhance risk strategies, and personalize customer offerings such as investment plans and loan options.

Process Automation

Automate repetitive financial operations using AI to boost efficiency and free up resources for high-value tasks across the organization.

Proprietary LLM Models

Develop tailored large language models and AI frameworks designed to address specific financial challenges and drive innovation.

Underwriting

Transform digital experiences with forward-thinking UX/UI design that prioritizes simplicity, security, and personalization to drive usage, trust, and conversions.

Our Fintech Platform Experience

By collaborating with fintech incumbents and integrating industry-leading platforms, we deliver world-class solutions that drive competitive advantages and establish our partners as market leaders.

Fraud, AML & KYC

Plaid

Riskified

TransUnion/Experian/Equifax

Forter

Sardine

Socure

Payments & Card Issuing

Stripe

Adyen

PayPal

Lithic

Fiserv

Zelle

Visa/Mastercard

Nium

Braintree

Checkout.com

Lightspeed

Marqeta

Dwolla

Lending

Credit Key

MoneyLion

Peach

Parafin

Capital Markets

iCapital

DriveWealth

Alpaca

Banking-as-a-Service

Galileo

Greendot

Plaid

Unit

Treasury Prime

Column

Helix

Income Verification & Payroll

Atomic

Finch

Codat

Featured Fintech Case Studies

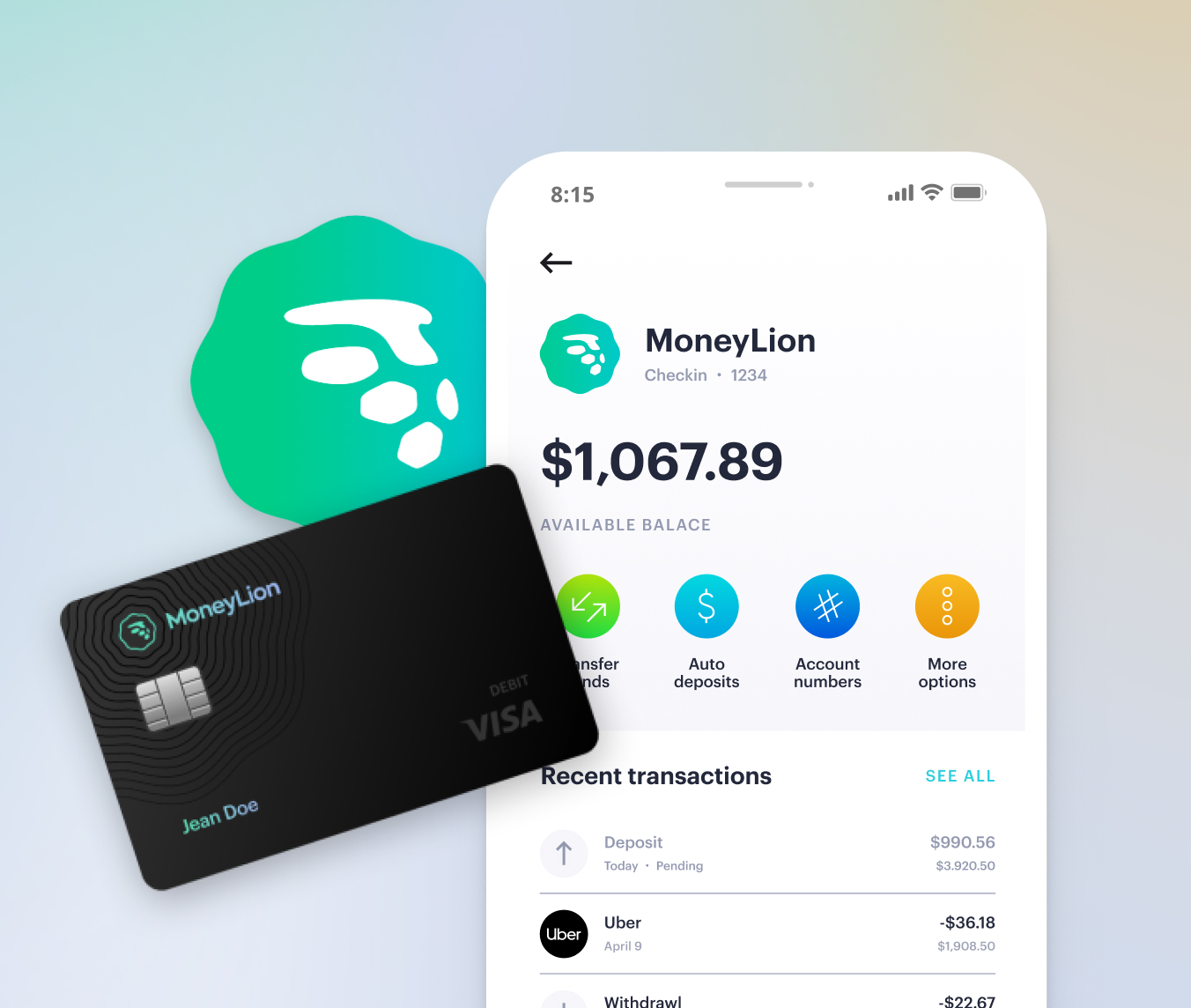

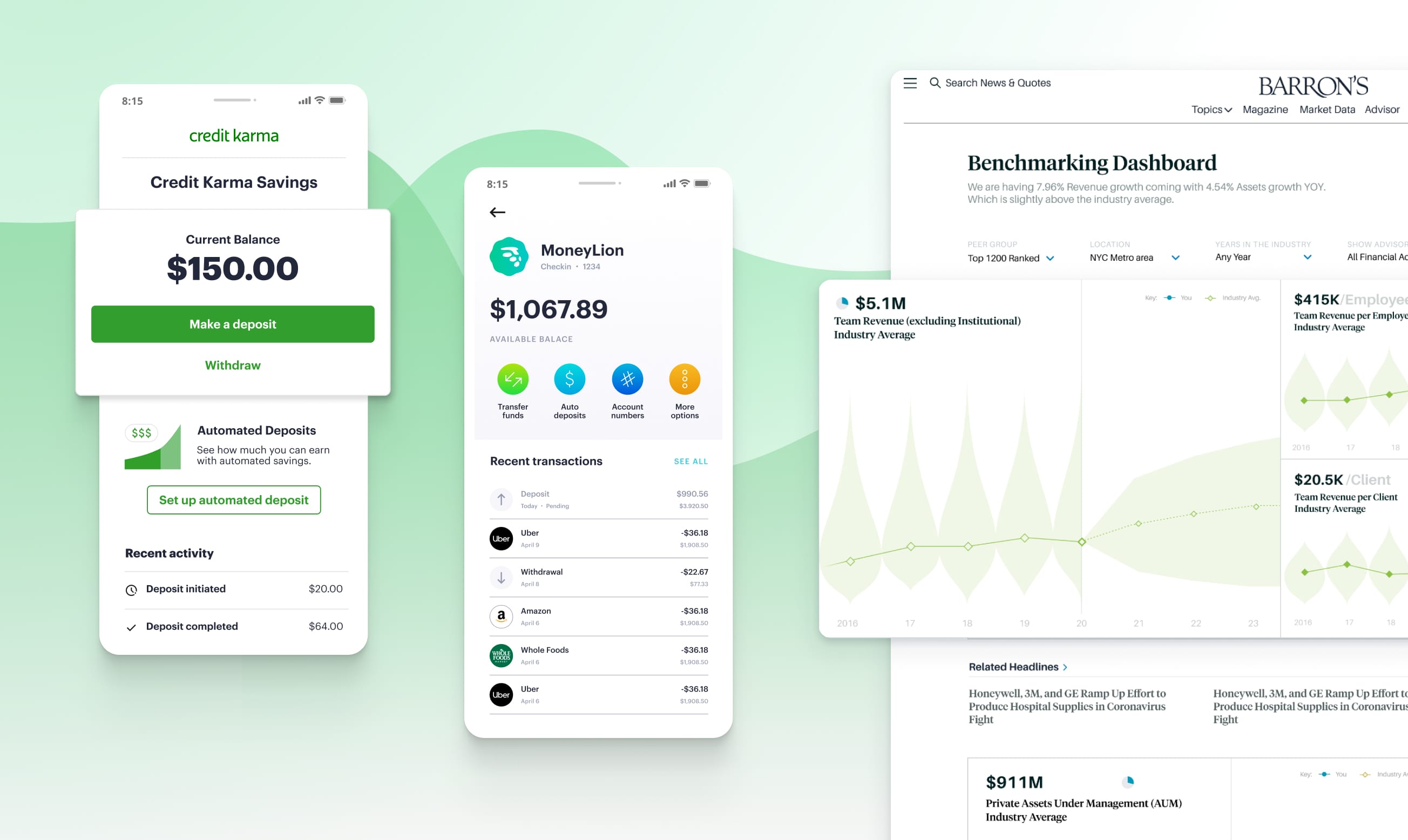

MoneyLion: Mobile Banking Product Development Helps Fintech Suite Scale

Mobile app development and cloud-native architectures create an easy-to-use mobile-first banking experience.

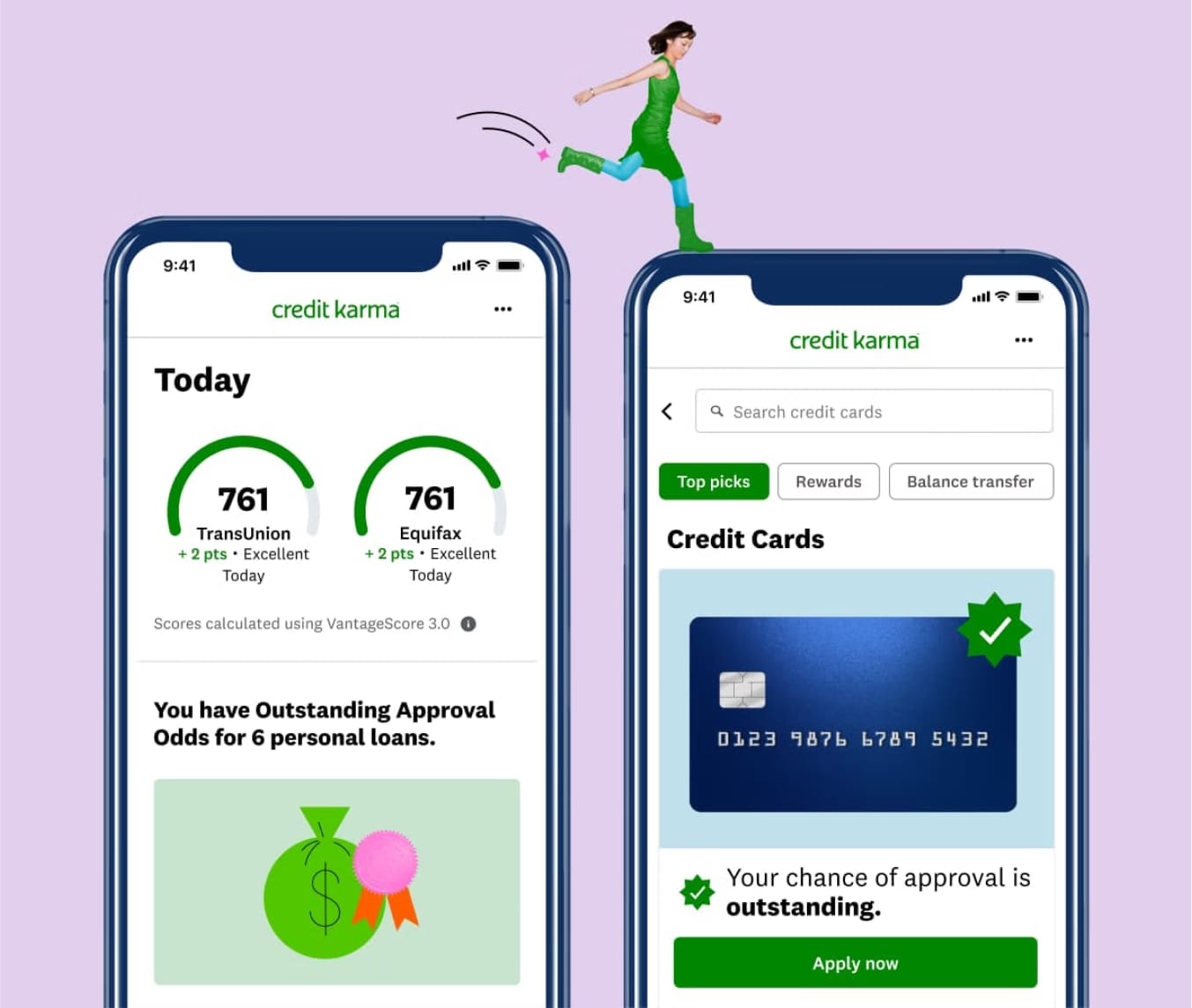

View Case StudyCredit Karma: Expanding the Most Modern Credit Monitoring Service into New Markets

Product engineering, UI/UX internationalization & integrations accelerate Fintech product launch in US, UK & Canada.

View Case Study